Employee 12 of Employee Provident Fund EPF. Reduction in rate of epf contributions from 12 to 10 of basic wages and dearness allowances is intended to benefit both 43 crore employees.

Basics And Contribution Rate Of Epf Eps Edli Calculation

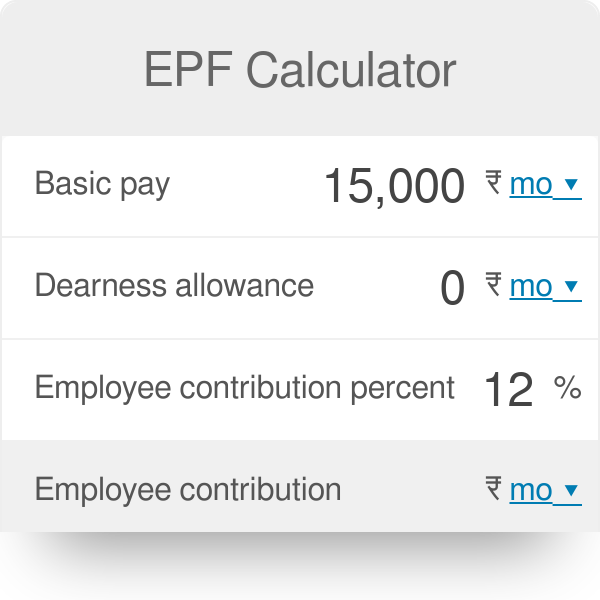

The full break-up of the percentage of contribution is as seen below.

. र सगठन20189235 dated 18072022. Any person who is employed for work of an establishment or employed through contractor in or in connection with the work of an establishment and drawing salary upto Rs15000- pm. Revised Rates of Contribution to various PF Accounts wef.

Additionally the employer also contributes 050 towards the Employees Deposit Linked Insurance EDLI account of the employee. Total EPF contribution every month 3600 2350 5950. Instead the statutory contribution rate for employees share will revert to the original 11 for members below the age of 60 and 55 for those aged 60 and above.

The EPF contribution rate for the financial year 2021 is 85. When wages exceed RM30 but not RM50. To clarify the government had lowered the EPF rate to 9 throughout the whole of 2021 to increase the disposable income of members during the height of the Covid-19 pandemic.

Beginning January 2018 employees will no longer have the option of contributing 8 of their income to the Employees Provident Fund EPF. Effective January 2018 cycle February 2018 EPF contribution the statutory contribution rate for employees share will revert to the original 11 for members below age 60 and 55 for those aged 60 and above. The total collection of administrative charges in 2017-18 is estimated at Rs 3760 crore.

The EPFO has decided to provide 850 percent interest rate on EPF deposits for 2019-20 in the. Employer s share - 12 Employees share -. KUALA LUMPUR Dec 21.

Wages up to RM30. A decrease of administrative charges by 015 would lead to reduction in collection of administrative charges by Rs 870 crore. Employers contribution towards EPF 3600 1250 2350.

In certain cases 10 PF rate is applicable wherein Employee Share to Ac No. When wages exceed RM70 but not RM100. Next year the Employees Provident Fund EPF contribution rate by employees will revert to the original 11 percent for members aged below 60 and 55 percent for those 60 and above.

EPF payment of Jun-2018 paid in July-2018 subject to a minimum sum of Rs500-. 75 for non-contribution of PF admin charges. Employees contribution towards EPF 12 of 30000 3600.

Employers contribution towards EPS subject to limit of 1250 1250. The employer contributes 12 of salary which is distributed as 833 towards the Employees Pension Scheme and 367 towards the Employees Provident Fund. 2 days agoEmployees Provident Fund Interest Rate Calculation 2022.

Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit HO No. WSU612019Income TaxPart-I E-333064581 dated 06. 1 will become 10 and Employer share will become 167.

Sql Account Estream Hq Effective From Jan 2018 Employees Epf Contribution Rate Will Be Revert As Follows A For Employee Below Age 60 Revert From 8 To 11 B For from. It was 865 in 2018-19 855 in 2017-18 and. EMPLOYEES PROVIDENT FUND ACT 1991.

1 day agoThe call by the MTUC came after the EPF contribution rate for employees was recently restored from 9 back to 11. 050 into PF admin charges from June 2018. The EPF contribution rate for the financial year 2021 is.

Ministry of Labour and Employment reduce in the rate of EPF Administrative charges from 65 to 50 which is effect from 1st June 2018. Employer Contribution to EPF. Revised rate of interest with regard to Staff Provident Fund in EPFO.

This will be effective from the January 2018 salary for February 2018 contribution. The applicable interest rate on EPF contribution for the financial year 2021-22 is 810. When wages exceed RM50 but not RM70.

Contribution By Employer Only. Salary for January 2018 Therefore the Contribution Month is February 2018 and it has to be paid either before or on 15 February 2018. Given below is a list of interest rates of some of the previous years-.

Rates of Contribution under EPF. The rates are revised from time to time.

What Is The Epf Contribution Rate Table Wisdom Jobs India

Epf Calculator Employees Provident Fund

Epf Contribution Reduced From 12 To 10 For Three Months

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

Epf Contribution Rates 1952 2009 Download Table

What Is Epf Deduction Percentage Quora

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Epf Contribution Rates 1952 2009 Download Table

Thank You Letter To Employees For Hard Work Letter Writing Tips Hr Letter Formats

The Central Board Of Trustees Of The Employees Provident Fund Organisation Epfo On 21st February 2019 Announced An Int Good News State Insurance How To Know

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

How Does A Lower Epf Contribution Impact Your Retirement Savings

Share And Stock Market Tips Epfo Signs Pact With Banks For Epf Contribution An Savings Account Financial News Changing Jobs

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

How Epf Employees Provident Fund Interest Is Calculated

Employees Provident Fund Malaysia Wikiwand

Epf Cut In Employee Contribution Means Take Home Is High But Will Increase Tds Liability Here S All You Need To Know Business News Firstpost